In-House Resources Give Advisor Expanded Capabilities to Serve High-Net-Worth Clients

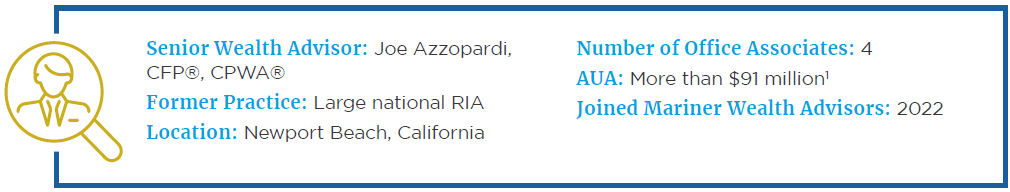

Office Snapshot

Advisor Gains Resources to Offer Clients More Personalized Wealth Solutions

Joe Azzopardi was searching for a firm with sophisticated in-house investment and wealth planning solutions as well as a culture that fueled his entrepreneurial spirit. Conversations with Mariner Wealth Advisors’ CEO and President Marty Bicknell sealed the deal. Azzopardi felt confident he would have access to the exceptional resources, support and growth opportunities he was looking for.

Attributes Azzopardi Looked For in a New Firm

- Investment solutions that could provide a customized experience for high-net-worth clients

- Access to advanced wealth planning resources and tools

- Management that is responsive to advisor needs

- A clear path for professional advancement and growth

“I’m incredibly impressed by Mariner Wealth Advisors’ ability to customize client portfolios using multiple solutions across different asset classes and different areas of the market,“ Azzopardi said.

Joe Azzopardi

Senior Wealth AdvisorWhy Mariner Wealth Advisors

- Collaboration with specialized in-house advisory solutions teams, from investment management to tax and estate planning services

- A broader menu of investment solutions, including stocks, hedged equity and structured notes

- Opportunities for growth at a business and professional level

“Mariner Wealth Advisors gives me access to in-house solutions that are the right fit for my high-net-worth clients,“ Azzopardi said.

More Time With Clients

Since joining Mariner Wealth Advisors, Azzopardi has gained the freedom to focus on his clients and business growth. His business is built on cultivating long-term client relationships, so when conversations and one-on-one meetings suffered for lack of time in the day, his bottom line did, too.

Azzopardi has discovered that support from Mariner Wealth Advisors’ advisory solutions and back-office teams frees up his day so he can make his clients a top priority. He spends his time taking care of his most important connections while leaving the logistical details to the firm’s in-house specialists.

Professional Growth Opportunities

Advisors appreciate the professional growth opportunities that come with being part of Mariner Wealth Advisors, a national firm with offices across the country and a steady growth strategy.

For Azzopardi, the prospect of continuing to grow as an advisor while satisfying his entrepreneurial ambitions was particularly attractive. Since joining Mariner Wealth Advisors, he has enthusiastically taken up the challenge of building his Newport Beach office into a hub for the firm in southern California.

“Serving my clients well while growing into a leadership role is important to me,” Azzopardi said. “Joining an established firm where I feel supported and valued gives me the opportunity to achieve my long-term entrepreneurial goals.”

Ready to Learn More?

If you’re looking for an opportunity to build your practice strategically, we offer different paths designed to fit your professional growth goals. Our client-first mission is at the center of everything we do. If that’s your priority, too, consider joining Mariner Wealth Advisors.

Sources:

1As of 9/30/22. Assets and AUA totals include a combination of assets under management and assets under advisement is not meant to represent regulatory assets under management. Please see Form ADV filings for specific information on regulatory assets under management.

Mariner Wealth Advisors (“MWA”) does not provide all services mentioned. Some services are provided by affiliates and are subject to additional fees. Previous results or outcomes experienced by advisors/clients are unique to those situations and there is no guarantee of similar results or outcomes.

Mariner Wealth Advisors (“MWA”), is an SEC registered investment adviser with its principal place of business in the State of Kansas. Registration of an investment adviser does not imply a certain level of skill or training.MWA is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MWA maintains clients. MWA may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by MWA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MWA, including fees and services, please contact MWA or refer to the Investment Adviser Public Disclosure website. Please read the disclosure statement carefully before you invest or send money.