In-House Support Helps Managing Director Grow Practice by 77%

Acquisition Snapshot

Managing Director Gains Resources and Grows Offices and AUA

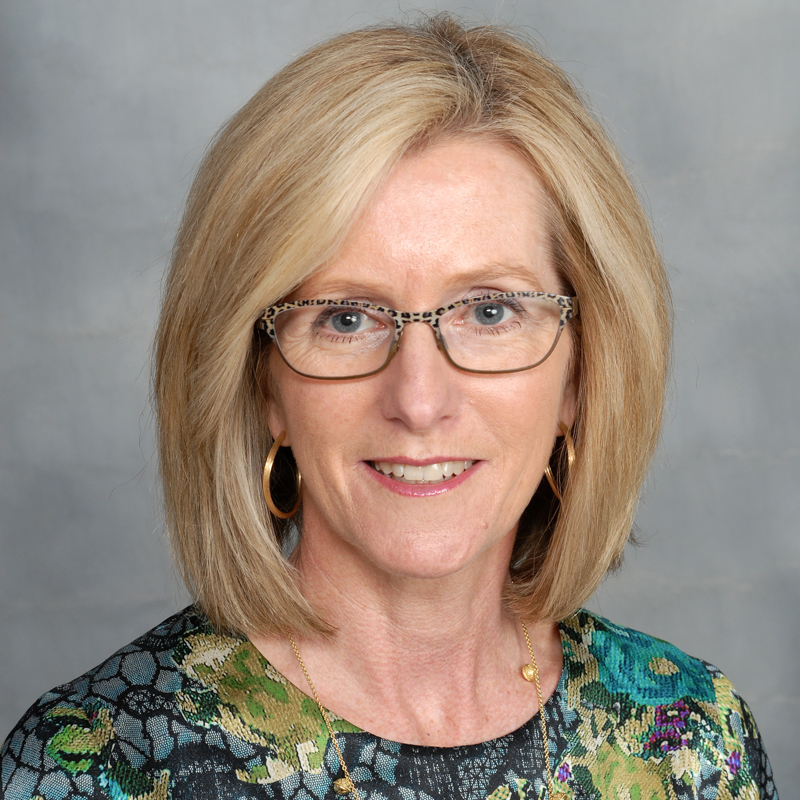

Jana Shoulders built a successful wealth management firm over 10 years. During that time, she found she and her associates spent too much time on back-office functions, leaving less time to focus on clients. Shoulders realized her practice had reached an inflection point and decided Mariner Wealth Advisors would offer her firm operational support and growth opportunities.

Challenges Shoulders Faced Prior to Acquisition

- Rapid growth that didn’t allow her team enough time to offer clients personalized attention

- Managing a large network of clients had become too much for a small firm to handle

- Lack of back-office support that resulted in too much time spent on daily operations

- Advisors on the team juggled too many roles, such as compliance officer, taking time away from clients

“Our firm had grown to the level where our practice management needs were demanding too much time from taking care of clients,” Shoulders said. “Connections were made, and relationships cultivated, but the one-on-one conversations suffered.”

Jana Shoulders, CPA, AIF®, AEP®

Managing Director, Senior Wealth AdvisorWhy Shoulders Chose Mariner Wealth Advisors

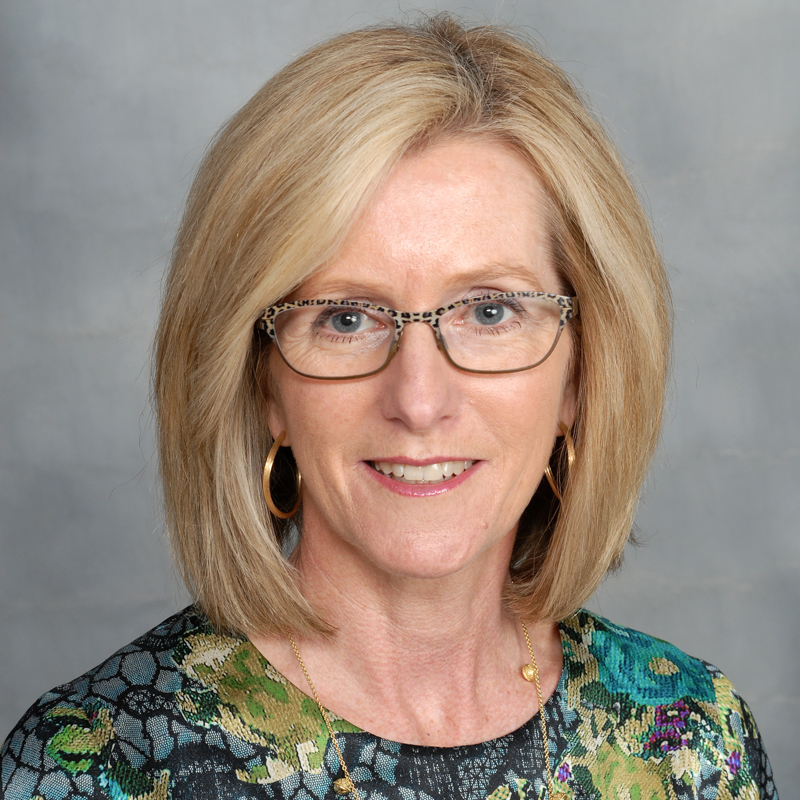

- Collaboration with in-house teams, such as investments, tax and insurance, which expanded the wealth planning services she and her team now offer clients

- Back-office support from teams including compliance, marketing, IT and operations, allowing Shoulders to spend more time growing her practice and less time running it

- Seamless acquisition for her clients and associates with the help of a dedicated transition team

- Growth opportunities—over the last decade, Shoulders added an office in Oklahoma City and expanded her role to include oversight of the Oklahoma tax team

“We crafted a plan to assimilate over an appropriate period of time that worked for everyone, and the team at Mariner Wealth Advisors made the transition as seamless as possible for our clients and associates,” Shoulders said.

Jana Shoulders, CPA, AIF®, AEP®

Managing Director, Senior Wealth AdvisorWe’ll Give You Time Back to Focus on Clients

Mariner Wealth Advisors provides advisors with support from in-house teams, which gives them time to focus on their clients and business growth. Individual relationships are typically where the plans are created—when those conversations and one-on-one meetings suffer, the bottom line can, too.

Shoulders and many other advisors have found that being part of the Mariner Wealth Advisors family gives them freedom to focus on the most important connections while leaving the logistical details to the firm’s support team.

When firms join Mariner Wealth Advisors, they can rely on support from experienced professionals who are part of a top-ranked* national advisory firm with offices across the country.

We’ll Help Make the Transition Seamless

The acid test of a successful transition—and one of the biggest concerns of firms considering joining Mariner Wealth Advisors—is client retention. A clear plan and confident implementation are essential to providing seamless continuity of service for clients.

Another big concern is the transition timeline. Mariner Wealth Advisors will create and implement a plan designed to meet your team’s needs and make it easy for you and your clients to make the switch.

Ready to Take the Next Step?

At Mariner Wealth Advisors, we believe the key to successful wealth management is relationships, which is one of the reasons why we provide the support from experienced teams to allow these connections to grow.

If you’re looking for an opportunity to build your business strategically, we offer different paths designed to fit your growth goals and values. Our client-first mission drives everything we do, so if that’s your priority, too, consider joining the Mariner Wealth Advisors family.

Sources:

1As of 6/30/22. Assets and AUA totals include a combination of assets under management and assets under advisement is not meant to represent regulatory assets under management. The total represents AUA for both Tulsa and Oklahoma City, OK. Please see Form ADV filings for specific information on regulatory assets under management.

Mariner Wealth Advisors (“MWA”), is an SEC registered investment adviser with its principal place of business in the State of Kansas. Registration of an investment adviser does not imply a certain level of skill or training.MWA is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MWA maintains clients. MWA may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by MWA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MWA, including fees and services, please contact MWA or refer to the Investment Adviser Public Disclosure website. Please read the disclosure statement carefully before you invest or send money.

Mariner Wealth Advisors (“MWA”) does not provide all services mentioned. Some services are provided by affiliates and are subject to additional fees.

Previous results or outcomes experienced by advisors/clients are unique to those situations and there is no guarantee of similar results or outcomes.